(Article and Model are just for learning purposes.)

The Indian dairy market industry has grown at a CAGR of ~10% between fiscal 2015 and 2020 to reach ₹6.7 trillion in fiscal 2020. This growth has come on the back of a 6-7% increase in volumes and 3-4% increase in price realizations. The dairy industry includes milk, traditional value added products (include Butter, Ghee, Paneer, Khoa, Curd & Skimmed milk powder) and embedded value products (flavoured milk, ice cream, yoghurt, cheese and whey). Over the last five years, the growth in the industry has been driven by value-added products (~35% of the industry in value terms) which have witnessed a growth of 12-14% between fiscal 2015 and 2020. Amongst the value-added products, emerging value-added products have grown at a faster rate of ~18% (owing to a ~12% increase in volumes and a 6% increase in prices) as compared to 12-13% for traditional value-added products. The fastest-growing products during this five-year period were ice cream at ~21%, followed by paneer (19%) and cheese (14%).

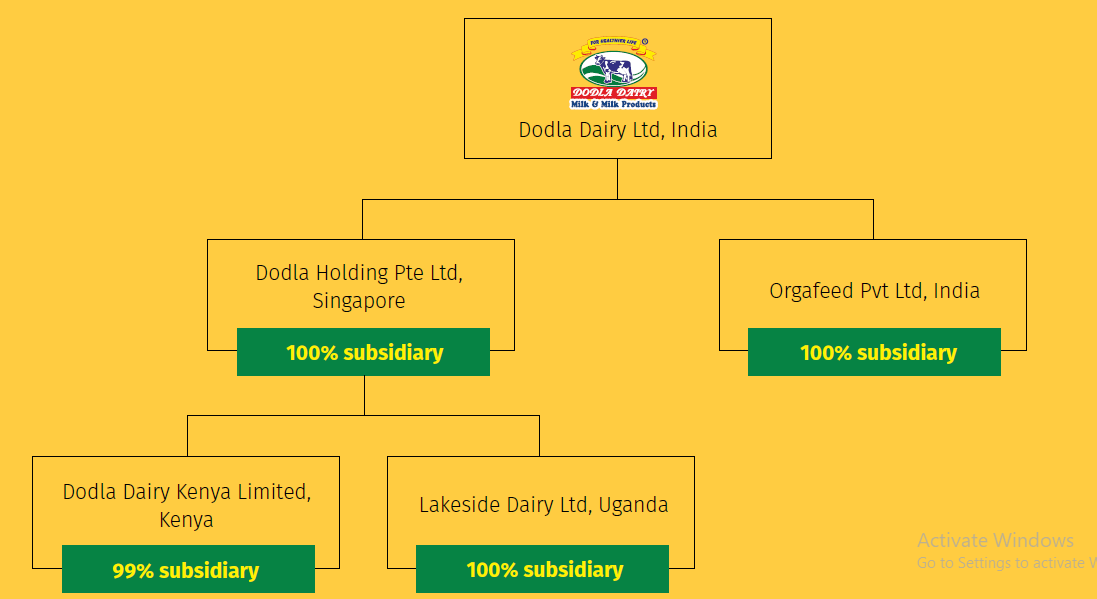

Dodla Dairy Limited (DDL) is a private dairy company in India. The Company also has overseas operations in Africa(Kenya and Uganda). Dodla commenced its production in the year 1998. The core business is dairy processing in liquid milk and value-added products

Dodla Dairy is the parent company and operates in India.

DHPL(Incorporated 2014) acts as an investment holding company for DDL.

DDKL (incorporated in 2017) primarily engaged in the trading of dairy products in Kenya.

LDL acquired Hillside dairy(Processing Plant) situated in Mbarra, Uganda in 2014.

OPL started in FY19 after acquiring Bharati Feed Mixing Plant and its operation is to sell cattle feed through DDL collection center

DDL has the following capability

| Processing | Procurement | Distribution |

| 15 Plants (India & Africa) | 121,214 Dairy farmers | 1799 Milk distributors |

| 21.5 lakhs Installed capacity | 7837 collection center | 563 Retail parlors |

| 80 MTPD Feed capacity | 113 Chilling center | 2986 Agents |

DDL Product offerings are as follows:

- Milk, Curd, Butter, Ghee, Paneer, Buttermilk and lassi, Sweets

- Flavored Milk, Ice Cream

Highlights from the latest quarter (Q2FY23)

- Revenues grew by 22.8 % YOY to 695 crores but declined 3.06 % QOQ.

- The company’s domestic business touched by 20.1% year-over-year to INR 644 crores, whereas the international business registered a strong growth of 70% year-over-year to INR 52 crores for the quarter(Q2F23).

- Milk procurement grew by 11.2% YOY to 14.3 lakh liters per day in Q2FY23, 12.8 lakh liters per day in Q2 of FY ’22.

- Milk sales grew by 14.7% YOY to 10.9 lakh liters per day as compared to 9.5 lakh liters per day in Q1 of FY ’23

- VAP sales grew by 19.3% YOY to 173 crores in Q2 of FY ’23 vis-a-vis INR 145 crores in Q2 of FY ’22.

- VAP, including fat and fat-based products contribution, stood at 25.3% of the overall dairy revenue during the second quarter of FY ’23 as compared to the 26% contribution of the overall dairy revenue during the same period last year.

- Curd sale during Q2 FY ’23 was at 292 metric tonnes per day as compared to 252 metric tonnes per day in Q2 FY ’22, increasing by 16% year-over-year.

- The procurement prices for the Q2 FY ’23 stood at INR 35 per liter and the net sales realization is INR 52.90.

- Dodla’s sales market is 30 – 35% metros compared to 60 – 65% non-metros based on a rough estimate.

- Adding other cattle feed plant of 12000-tonne capacity and will be operational in March April FY23.

- The company has around 7% of the market share in the areas where they are operating.

- 93.5% of Milk is directly procured from farmers

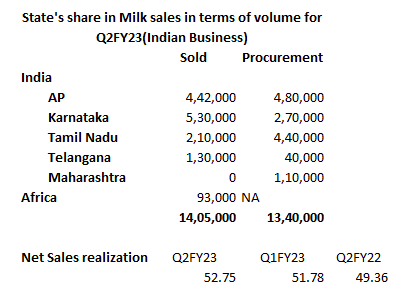

As we can see DDL sold 70% of milk in two states i.e. AP and Karnataka.

The company has only 5% Buffalo, the balance 95% is cows and 40% of sales quantity is coming from Karnataka which is predominantly in the cow’s milk sales. Hence, the net realization is 52.75

| Particulars | Volumes (Q2FY23) | Revenue (crs) (Q2FY23) | EBITDA Margin |

| Curd (MTPD) | 292 | 125 | 15-16% |

| Ice Cream (LPD) | 3000 | 4.44 | 15-18% |

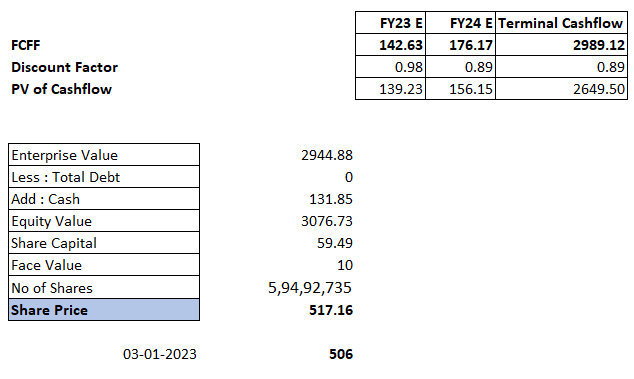

I have projected for two years and discounted FCFF to get fair value. for the rest of the assumption, refer to model provided at the end of this article

Looking ahead:

- Strengthen our footprint in Southern Karnataka, Goa, and Maharashtra markets.

- 10 – 15 Crs in maintenance CAPEX for 15 plants and 20 – 25 crores on procurement, distribution, and chilling center and 10 – 15 Crore in Africa, and the rest depends on acquisition opportunity with higher ROC.

In a normal global scenario, dairy companies normally tend to go into becoming the food company in the long term because we have the network for placement of products and other items, even if you compared Amul in India, so they've gone into a whole host of other products like chocolates also. I think we are following the same path in that we still have a lot more room to grow in milk for the short term of two years, or three years, and later will be multiple products to food can also come into play.

Sources:

DDL DHRP, Annual report, Concall Transcript, and public sources.